What is it?

Disability insurance provides a tax-free monthly benefit to the insured in the event of an illness or accident that restricts them from being able to work. This benefit allows the insured to meet financial obligations and maintain their lifestyle in a difficult time. Our catalogue of disability products is comprehensive:

benefit periods – the amount of time you receive the payment – ranging from the short-term to the long-term benefit amounts – the amount you receive every month – ranging from the hundreds to tens of thousands products built for professions of all types.

How does it work?

Disability insurance acts as a replacement for a percentage of your income in the event that you can’t work as a result of an illness or accident. The process of obtaining disability insurance in Winnipeg begins by determining how much insurance you require. It is commonplace if not mandatory for individuals to insure their homes and their vehicles. However, many fail to adequately insure their income. People often underestimate the amount they will earn through their working years. For example, someone 30 years of age making $70,000/year will make over $3,800,000 prior to retirement assuming a regular cost of living increase. Ensuring that one’s future earning potential is properly protected is key in protecting much of what one deems valuable.

Traditionally, the all-source maximum for one’s disability benefit is 85%. This means that all-sources of post-disability income cannot exceed 85% of what one was earning prior to the disability. Carefully calculating this figure is key in ensuring the implementation of an efficient disability strategy. In addition, there are 3 more crucial variables to define prior to applying for disability coverage:

employment classification

waiting period

benefit period

The above variables along with:

age

smoker status

health history

occupation

Will determine your disability rates.

Each disability insurer has pre-assigned nearly all occupations, spanning from axe throwing company owner to zoo therapist, with a classification code. This code represents the risk associated with any particular occupation and consequently contributes to determining the premium. The classification codes vary slightly from insurer to insurer; however, the following is a rough breakdown of how the system works:

4S

This classification offers preferred rates to select professionals and executives. To qualify for this classification, one must meet a number of criteria which, in the eyes of the insurer, lower the likelihood of experiencing a disability. Most commonly, individuals in the medical field (excluding emergency medicine), lawyers, business owners, and other white-collar workers who meet specific criteria occupy this class.

4A

The 4A classification houses select business professionals who do not meet the salary and experience thresholds to upgrade to a 4S classification. Examples of occupations which often receive the 4A classification are architects, PhD scientists, teachers, and financial professionals.

3A

Primarily office workers with light sales duties and no manual labour responsibilities occupy the 3A classification. So, we often see office managers, office workers, and scientists with an Undergraduate of Master’s degree be assigned the 3A classification.

2A

The 2A classification is similar to the 3A and often includes sales professionals and other skilled workers who are often travelling from place to place during working hours. Occupations such as locksmiths, insurance adjusters, home inspectors, and reporters are commonly classified as 2A.

A

The A classification contains certain industry and trades workers. Receiving the A classification is possible when particular criteria relating to working conditions (i.e. proximity to chemicals, heavy equipment, etc.) are met. Mechanics, bus drivers, and electricians are examples of occupations which often carry the A classification.

B

The B class is the final designation. Occupations which receive this classification often require significant physical exertion or have a high-risk of accident. Additionally, occupations with a history of employment instability may receive the B classification. Some examples of occupations which commonly receive the B classification are as follows: disk jockeys, blacksmiths, concrete workers, roofers, and heavy-duty mechanics.

After determining the appropriate occupation class, proceeding through the following steps are required:

Here, the unique circumstances and preferences of the individual client are paramount. The waiting or elimination period is the amount of time the insured must wait after becoming disabled before they will begin receiving their disability benefit. A longer waiting period translates to a lower premium as the insured may recover quickly and not receive the benefit if the waiting period is longer. Some clients may prioritize a lower premium or have significant savings. As a result, they may elect for a longer waiting period. Traditionally, you can select a 30, 60, 90, or 120-day waiting period.

The benefit period is the amount of time the insured will receive the disability benefit. Commonly, we see clients elect for the age-65 benefit period. Selecting this option results in the insured receiving the disability benefit until age 65 or until they are able to resume work, whichever comes first. Other benefit periods are commonly either 2 or 5 years.

Once an appropriate monthly benefit amount is calculated, the proper employment code is derived, and the waiting and benefit periods are determined, the next step is to apply for the coverage.

All insurance applications are no-obligation. This means that an applicant can cancel the process anytime, even after the policy is approved, at no cost to them. For clients aged 18 through 50 who seek a benefit less than $6000/month, we can often accelerate the application’s underwriting and have the policy issued without the need for biometrics. This means no blood, urine, or vital tests. After the policy is approved, you can enjoy the security granted by properly insuring their hard-earned income.

Who benefits from it?

Individuals of any age and background can experience an accident or illness which restricts their ability to work. Listed below are a couple of real-life claim examples:

Age 36, Chronic Fatigue,

$881,373 disability benefit paid from

2001 to 2018

age 29, back injury,

$536,036 disability benefit paid from

2003 to 2018

age 32, brain aneurysm,

$272,422 disability benefit paid from

2005 to 2018

age 37, major depression,

$637,846 paid from 1998 - 2018

Who can apply?

Anyone over the age of 18 and under the age of 61 who is working can apply for disability coverage. Many individuals have some form of existing disability coverage; be it through their employer or privately. These individuals, too, may be in need of either additional or replacement coverage. Remember, if you were to leave your job, your coverage often ceases.

What are the odds of an accident happening?

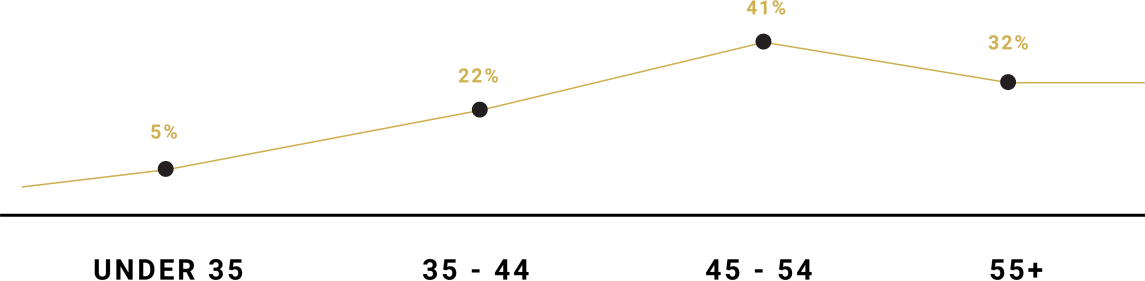

A disability can strike any person at any time. 25% of Canadians will experience a disability which lasts at least 90 days due to injury or illness prior to age 65. The disabilities that last longer than 6 months average a duration of 6 years. Listed below is the disability-claim breakdown by age:

What disabilities are covered?

The Government’s Canadian Pension Plan (CPP) and Worker’s Compensation benefits certainly help those who can utilize them. However, the CPP benefit only pays out if the disability is such that one cannot perform any job, not just their chosen profession. Furthermore, Worker’s Compensation only results in a benefit being paid if the disability is caused by a workplace incident.

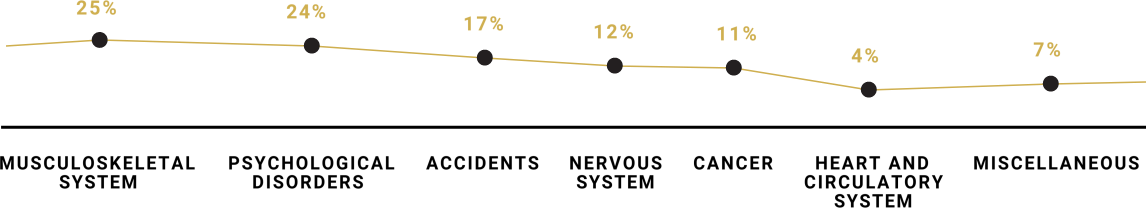

Our disability products result in a benefit regardless of the cause of one’s disability. The list below depicts various disabilities and the percentage of claims each are responsible for: